The Importance Of Understanding Market Sentiment

Understanding market sentiment is crucial for making informed decisions in the world of business and finance. It reflects the general mood or attitude of investors, consumers, and other stakeholders towards the market or specific assets. Market sentiment can play a significant role in shaping prices, influencing economic trends, and guiding strategic planning. This article dives into the various aspects of market sentiment, its impact, and why it is important to pay close attention to it.

What Is Market Sentiment?

Market sentiment refers to the collective feelings or attitudes of participants in the market, often expressed through price movements and trading volume. It can be described as either positive, negative, or neutral, reflecting the general outlook of those involved in economic activities. When sentiment is positive, investors are more likely to buy, and prices tend to rise. Conversely, negative sentiment leads to selling, which can drive prices down. Sentiment can be shaped by various factors, including economic reports, news events, political developments, and even social media.

Market sentiment is not always a direct reflection of fundamental values like earnings reports or GDP growth. Instead, it often encompasses the psychological factors at play, such as fear, greed, and hope, that influence market behaviour. For example, during times of uncertainty, market sentiment may shift from optimism to fear, causing rapid declines in stock prices, even if the underlying fundamentals remain unchanged.

How Market Sentiment Influences Investment Decisions

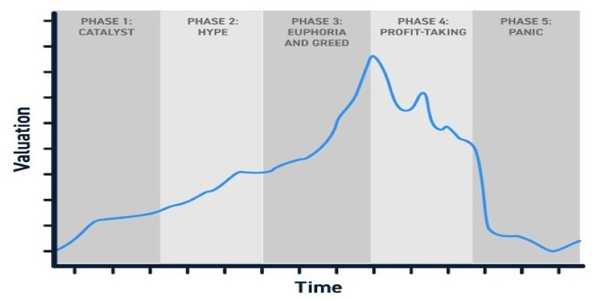

For investors, understanding market sentiment is essential because it provides insight into how others are likely to behave. When sentiment is overwhelmingly positive, it can create market bubbles, where prices rise above their intrinsic value. In contrast, negative sentiment can lead to market crashes, where assets become undervalued despite their long-term potential.

Investors use sentiment analysis to gauge whether the market is overreacting to news or events. For instance, if the market reacts negatively to a piece of news, it might present buying opportunities if the fundamentals of a company or asset remain strong. Similarly, if market sentiment is overly bullish and detached from underlying economic conditions, it could signal the need for caution.

Beyond understanding market psychology, sentiment analysis can also assist in timing investments. By observing shifts in sentiment, investors can identify turning points in the market. A shift from negative to positive sentiment, for instance, may signal the beginning of a recovery, while a shift in the opposite direction could indicate the onset of a downturn. By anticipating these changes, investors can adjust their strategies to capitalize on potential opportunities.

The Role Of Market Sentiment In Economic Forecasting

Market sentiment plays a critical role in economic forecasting because it influences both consumer spending and business investment decisions. A positive market sentiment often encourages consumers to spend more freely, which stimulates economic growth. For businesses, positive sentiment can lead to increased investment in expansion and innovation. When confidence is high, businesses are more likely to invest in new projects, hire additional staff, and engage in other activities that contribute to economic growth.

On the other hand, negative sentiment can have the opposite effect. When consumers and businesses are feeling pessimistic, they may cut back on spending and investment. This reduction in demand can lead to slower economic growth, job losses, and decreased market activity. Economic policymakers often look at indicators of market sentiment, such as consumer confidence and business sentiment surveys, to help predict the future direction of the economy.

One of the primary tools used in market sentiment analysis is the consumer confidence index (CCI). This metric tracks how optimistic or pessimistic consumers are about the future economic situation, which directly impacts their spending behaviour.

The Impact Of Social Media And News On Market Sentiment

In today's digital age, social media and news outlets play a major role in shaping market sentiment. The rise of platforms like Twitter, Facebook, and Reddit has given individuals unprecedented power to influence market sentiment in real-time. A viral news story or a tweet from a well-known figure can cause massive shifts in market behaviour. This is particularly true in the context of retail investors who may follow trends or react quickly to online discussions.

For example, during the GameStop stock surge of 2021, a group of retail investors on Reddit's WallStreetBets forum drove up the stock price by collectively buying shares. This dramatic rise in sentiment, fueled by online discussions, caught the attention of both institutional investors and the media, leading to massive price volatility. This event highlighted how market sentiment, driven by social media platforms, can have a significant impact on stock prices, regardless of the company's financial fundamentals.

Similarly, news outlets play a crucial role in shaping sentiment. Positive news, such as strong corporate earnings reports or favourable government policies, can drive market optimism.

The Limitations Of Market Sentiment

While understanding market sentiment is essential, it is not a foolproof method for making investment or business decisions. Sentiment can often be irrational and driven by emotions rather than objective facts. Investors might become overly optimistic during market booms, leading to asset bubbles, or they may panic during downturns, causing prices to fall below their actual value.

Moreover, market sentiment can be short-lived, and it does not always align with long-term fundamentals. For instance, a stock may experience a sharp drop due to negative sentiment following an earnings miss, even if the company’s long-term prospects remain strong. This creates potential opportunities for contrarian investors who recognize that sentiment-driven price movements can be temporary and may not reflect the company’s true value.

Another challenge in analyzing sentiment is the risk of information overload. With so much data available, distinguishing between noise and meaningful signals can be difficult. Social media, in particular, can amplify false information or speculative rumours, which can distort sentiment and create volatility. Traders and investors need to be cautious when interpreting sentiment data and ensure they are not reacting impulsively to short-term events.

Conclusion

Understanding market sentiment is a vital skill for anyone involved in business or investing. It helps guide decisions, manage risks, and predict future market movements. By understanding the emotional undercurrents that drive market behaviour, individuals can make more informed choices and potentially capitalize on market shifts before others do.